Annex 4.4 Business models for self-supply

The saving of electricity provided by generation can constitute a good business opportunity, depending of the patterns of consumption and the primary generation resource available in the area, the required investment and the cost of financing, the electricity cost of the network and the percentage of self-consumption. There are 3 business models for the self-supply that can be exploited and that are applicable to both small-scale generation under the Netbilling Law and PMGD projects and projects with no surplus to the network and are as follows:

a) The consumer buys the plant or generation equipment

b) The consumer rents the plant or generation equipment or signs a lease agreement

c) ESCO Model (Energy Service Company)

Each of these business models with their main advantages or disadvantages is briefly described below.

Under this model, the customer or user of energy is the owner and operator of the plant, which is why it is responsible for the electrical production, equipment and maintenance of the plant. The main barrier of this business model is the initial investment required. In the case of projects under the Netbilling Law, which are aimed at residential, commercial or small-scale generation, customer may often not have the initial capital or simply do not wish to take the risk of the investment. In the case of PMGDs, if it is aimed at self-supply, consumers are often not experts in the development of these projects and do not want to take the risk.

In general, the business model of buying the plant or the generation equipment is oriented to companies with a high degree of knowledge of the electricity sector whose main turn is the sale of energy to the system and not self-supply.

Under a model of renting the generation equipment the customer pays a monthly fee to the company that owns the equipment. This company makes the initial investment and is responsible for the equipment. However, the customer is responsible for the electrical production. This business model represents less risk than the first model of purchase of generation equipment. In the case of projects under the Netbilling Law, which are aimed at residential, commercial or small-scale generation, this means an additional monthly cost that is often difficult to predict if it will be able to be covered by energy savings.

Energy Service Company or ESCO is a company format whose business is to achieve energy savings. In this way, the ESCO makes the investments and recovers them with a fraction of the economic savings that the user produces. This business model is envisaged with a great development potential because under this framework, ESCO is the owner and responsible for the equipment and the electrical production. In this way the consumer practically does not take risks of investment or operation.

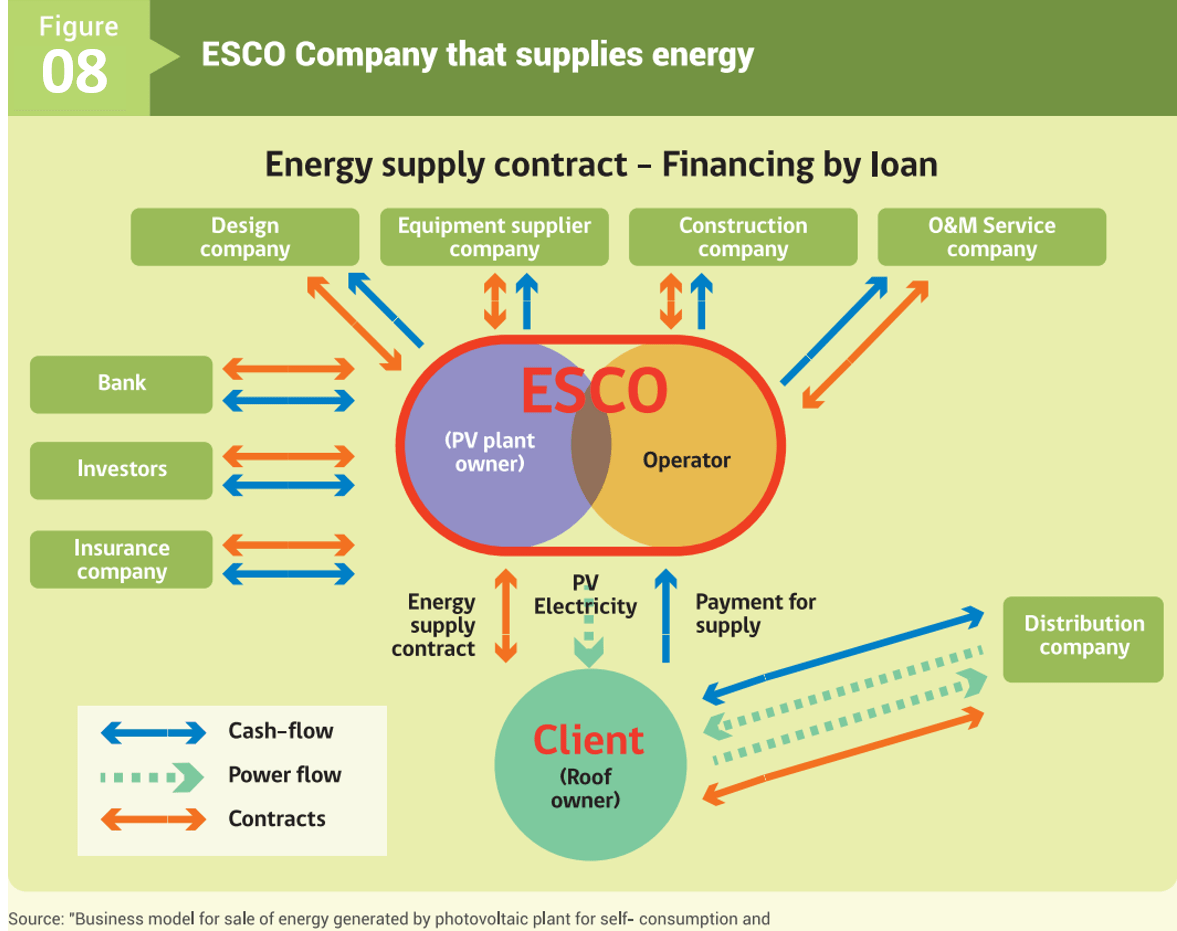

There are 2 variants of the ESCO model, one corresponds to which the company ESCO supplies the energy and therefore the customer buys the energy at a price lower than the one bought in the network and the other variant corresponds to the model in which the income of the ESCO is based on the energy savings achieved by the consumer. The latter is widely used in contracts of companies that perform energy efficiency, but is less frequent in the contracts of generation companies. The ESCO power supply business model is the one that has taken the most force and is described briefly below.

Under the ESCO model of energy supply a long-term energy supply contract (10 to 15 years) is established for a price per kWh determined between the ESCO Company and the consumer. At the same time, ESCO is responsible for the investments, studies, installation and maintenance of the generation equipment. In this way, ESCO acts as an intermediary between the consumer and the design, construction, supplier and operation and maintenance companies and assumes all investment risk. The consumer, owner of the building where the generation project will be built/installed, should only pay energy to the ESCO.