6.1. Overview of marketing alternatives

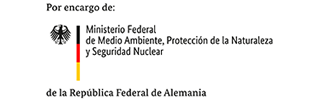

Figure 32 shows, in general terms, the different commercial alternatives of a NCRE. It also illustrates the type of agreement made. For example, with non-regulated customers, contracts are agreed between the parties, whilst in the case of the spot market, transactions are conducted at marginal cost.

This gives rise to different business models for NCRE projects in the Chilean electricity market, considering the following:

- Sale of energy and power to other generation companies, through the Coordinator, in the spot market to the instantaneous marginal price for energy and the node price of the power to other generation companies.

- Sale of energy and power, through the Coordinator, in the spot market at a stabilized price of energy and the node price of power to other generation companies. This mechanism only applies to small-scale generation media according to the S.D. N°88.

- Sale of energy and power to a distribution company, through a regulated tender, where the price of energy corresponds to the stipulated in the tender in case of being adjudicated and the price of power, at the node price of the power in force at the time of the tender.

- Sale of energy and power to a generating company through a long term contract at agreed energy and powerprices.

- Sale of energy and power to a free customer in a long-term contract at prices to be agreed for anergy and power.

All previous marketing alternatives correspond to the wholesale energy market, however, it should be noted that there are others business models for self-consumption projects under the Netbilling Law. For these types of projects the model that is envisaged with great potential for development is the ESCO or Energy Service Company model. Under this model, the ESCO makes the investments and recovers them with a fraction of the economic savings that the user produces. That is, the ESCO offers the service of installation and operation of the equipment, which it maintains for some years as property until the entire service is paid and becomes the property of the user. It should be noted that the ESCO can offer its service in concession areas to consumers, since this occurs on private properties. This and other business models for distributed generation projects are explained in greater detail in Annex 4.

Next, different alternatives of business models are described in the wholesale electricity market.

The spot market is the default market of any generator that enters the Chilean system. In this market, only power generation companies generate energy. Its main characteristics are:

- In this market each generator sells or buys energy depending on the dispatch of its generating units and the contracts (supply).

- Generators sell all their produced energy in the spot market in the bar or injection node.

- Generators buy energy and the spot market to supply their contracts in the bar or supply node.

- Only generators participate in this market.

- Purchase and sale of electricity is conducted at short-term marginal cost (hourly) at the respective busbar or node where the electricity is withdrawn (for consumption) or where generators inject.

- The marginal cost is characterized by its volatility associated with short-term supply and demand shifts.

- Spot market transactions are calculated monthly by the Coordinator, once the actual values of the transaction are known.

The payment for capacity (or power) corresponds to an instrument to stimulate sufficiency in the electricity market, which is also consistent with the two-part marginal pricing scheme, where the peak period prices are different in the market in the rest of the time. Thus, in the case of electricity, part of the price is the energy that is associated with variable costs of production and is charged per unit of consumption. The other part, the capacity or power, is a charge for the availability to provide the service, which is possible through the installation of capacity, i.e. corresponds to an infrastructure development charge. In this way, the capacity charge includes the costs of providing this infrastructure, which corresponds to fixed capital costs, and is allocated among the consumers who demand in the peak conditions of the system.

Regarding to the spot market, the characteristics are as follows:

- Generators sell their recognized power in the spot market in the bar or injection node.

- Generators buy power in the spot market to supply their contracts in the bar or supply node.

- Only generators participate in this market.

- The purchase and sale of power is conducted at the nodal price for power at the respective busbar.

- The nodal price of power is calculated every six months by the CNE, in April and October. According to marginal theory, this price is based on the investment cost and on operational and maintenance costs (O&M) of a generation unit capable of supplying power to the system during peak demand.

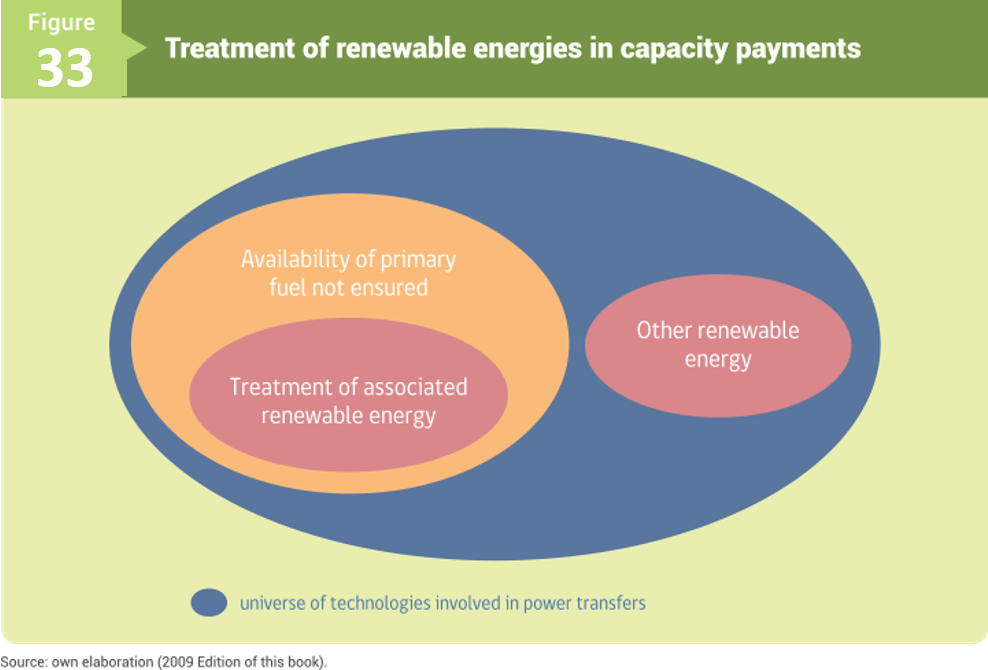

The treatment of renewable energies is not decontextualized from the general scheme with which the Chilean system addresses payments for power or capacity, with the associated sufficiency and safety requirements. Figure 33 illustrates this situation, where the technologies or generation plants are distinguished without the assured availability of their primary energy source during the analysis period, for example wind power or fossil fuels that show problems in their supply. However, there may be renewable sources that if they guarantee a high availability of their capacity, such as biomass or geothermal.

S.D. N°62 of 2006 regulates power transfers between generating companies. Annex 3 describes the methodology for calculating the recognized adequacy power for each type of power plant.

The contract market corresponds to a market of the financial type with private contracts freely agreed between the parties. As long as a NCRE project is an electricity company, the valid procedure for any generating company in the sector is applied.

The requirement of quotas of generation of NCRE defined in Law 20.257 and Law 20.698 translates into the possibility of marketing, by any electric company that exceeds its obligation of non-conventional renewable energy injections, the transfer of its surplus to another electric company. This transfer can be commercialized bilaterally at freely agreed prices and independently of energy sales.